Should the U.S. bring factory jobs back?

Investing.com -- Aiming to restore manufacturing jobs may be a misguided goal in today’s economy, experts argue as the White House pursues broad tariffs to bring factory work back to U.S. shores.

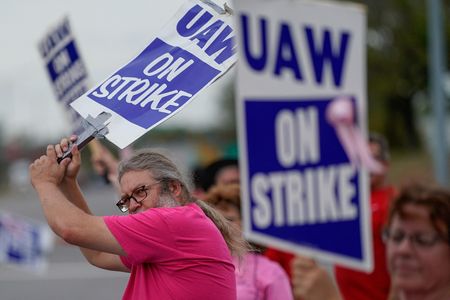

While the latest trade measures span agriculture and natural resources, the push to "reshore" manufacturing is central to current policy. But analysts at CIBC (TSX:CM) warn that tariffs could backfire, raising costs for domestic producers and provoking retaliation that threatens export-related jobs.

The U.S. entered 2025 near full employment, meaning any manufacturing gains would mostly involve reallocating workers from other sectors rather than reducing joblessness. “Such a reallocation would not… represent a clear improvement in American living standards,” the report said.

Manufacturing’s share of GDP and employment has declined steadily, largely due to automation and outsourcing of low-productivity tasks. Many lost roles, such as sewing or meatpacking, offered limited pay and are unlikely to appeal to younger jobseekers.

Moreover, factory wages have lagged. Average hourly wages in manufacturing stopped topping average private sector pay a decade ago with that gap widening since the pandemic. Meanwhile, productivity growth in the sector hasn’t translated into better compensation due to falling prices of manufactured goods.

Even sectors like autos and metals, where tariffs have been applied, would need millions of new workers to meet demand without imports—a challenge given tight labor markets, aging workers, and a lack of vocational training.

CIBC concludes that while sector-specific trade action may be justified on strategic grounds, bringing back broad-based factory employment is neither practical nor likely to lift living standards. “Tariffs might fail to bring back manufacturing jobs for a host of reasons,” the CIBC report said, “but even if they worked… the goal itself might not represent the win that many believe.”

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.CM: is this perennial leader facing new challenges?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Sure, there are always opportunities in the stock market – but finding them feels more difficult now than a year ago. Unsure where to invest next? One of the best ways to discover new high-potential opportunities is to look at the top performing portfolios this year. ProPicks AI offers 6 model portfolios from Investing.com which identify the best stocks for investors to buy right now. For example, ProPicks AI found 9 overlooked stocks that jumped over 25% this year alone. The new stocks that made the monthly cut could yield enormous returns in the coming years. Is CM one of them?

Unlock ProPicks AI to find out