Eli Lilly’s weight-loss drug sales miss expectations, shares fall

(Reuters) - Eli Lilly (NYSE:LLY) on Thursday posted better-than-expected quarterly results, although sales of its popular weight-loss drug, Zepbound, came in slightly below Wall Street estimates, sending its shares down 4% in premarket trading.

Separately, CVS Health (NYSE:CVS) said that its pharmacy benefit management unit would drop Lilly’s Zepbound as a preferred product from its list of drugs eligible for reimbursement from July 1, but would retain rival Novo Nordisk (NYSE:NVO)’s Wegovy.

The success of Lilly’s diabetes and weight-loss treatments has led Eli Lilly to become the world’s most valuable healthcare company, with a market capitalization of more than $800 billion.

It competes with Danish drugmaker Novo Nordisk in the lucrative market for these treatments, known as GLP-1 agonists.

Zepbound posted sales of $2.31 billion for the first quarter, while analysts were expecting sales of $2.33 billion, according to LSEG data.

Lilly said lower prices for the drug impacted revenue, but demand remained strong. In February, Lilly had cut the price for vials of Zepbound by $50 or more and expanded the range of doses it sold online.

It now offers the two lowest doses of Zepbound for $349 and $499 for a month’s supply.

The company cut its annual adjusted profit forecast to between $20.78 and $22.28 per share from its previous expectation of between $22.50 and $24.00 per share.

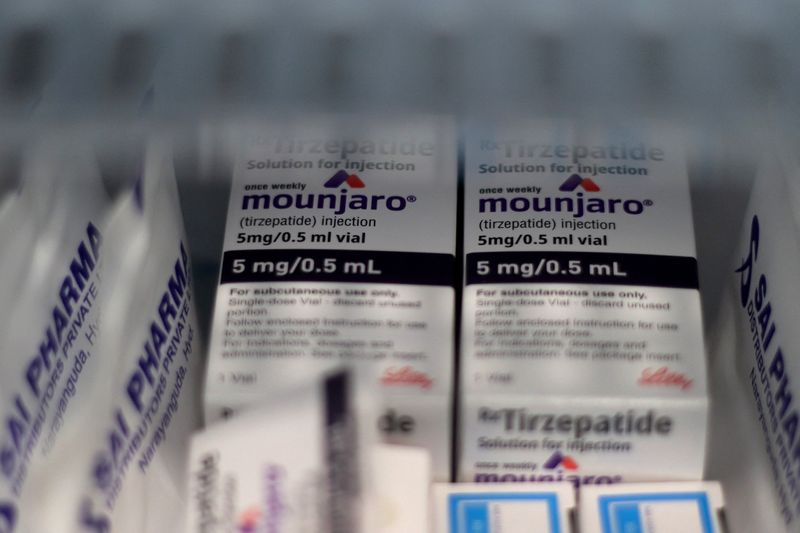

Sales of diabetes drug Mounjaro came in at $3.84 billion while analysts were expecting sales of $3.80 billion, according to data compiled by LSEG.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.On an adjusted basis, Lilly earned $3.34 per share for the quarter, compared with analysts’ estimates of $3.02 per share.

Total revenue was $12.73 billion for the quarter ended March 31, compared with expectations of $12.67 billion.

Is LLY truely undervalued?With LLY making headlines, investors are asking: Is it truly valued fairly? InvestingPro's advanced AI algorithms have analyzed LLY alongside thousands of other stocks to uncover hidden gems with massive upside. And guess what? LLY wasn't at the top of the list.

Unlock ProPicks AI