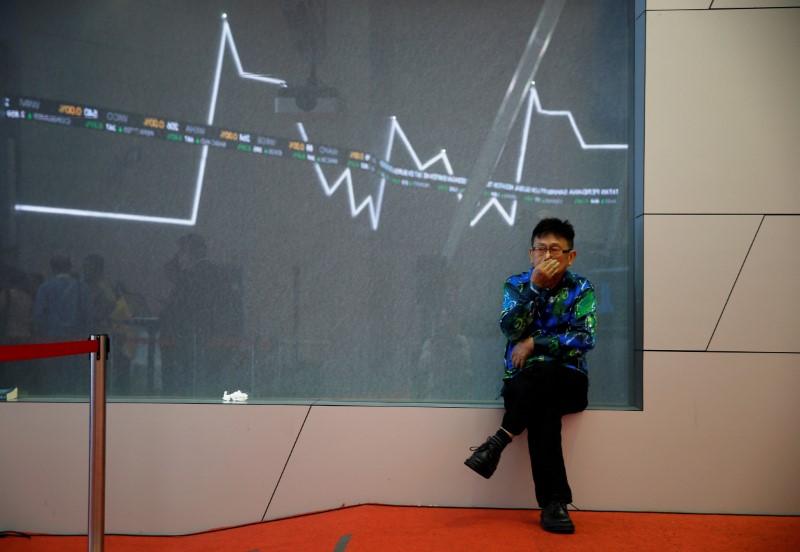

Indonesia stocks higher at close of trade; IDX Composite Index up 1.17%

Investing.com – Indonesia stocks were higher after the close on Friday, as gains in the Financials, Infrastructure and Agriculture sectors led shares higher.

At the close in Jakarta, the IDX Composite Index gained 1.17%.

The best performers of the session on the IDX Composite Index were PT Wulandari Bangun Laksana Tbk (JK:BSBK), which rose 34.85% or 23.00 points to trade at 89.00 at the close. Meanwhile, Pembangunan Graha Lestari Tbk (JK:PGLI) added 34.76% or 65.00 points to end at 252.00 and MPX Logistics International Tbk PT (JK:MPXL) was up 30.50% or 43.00 points to 184.00 in late trade.

The worst performers of the session were Sentral Mitra Informatika Tbk PT (JK:LUCK), which fell 11.32% or 12.00 points to trade at 94.00 at the close. Kian Santang Muliatama PT (JK:RGAS) declined 11.11% or 13.00 points to end at 104.00 and M Cash Integrasi Tbk PT (JK:MCAS) was down 9.74% or 95.00 points to 880.00.

Rising stocks outnumbered declining ones on the Jakarta Stock Exchange by 418 to 259 and 169 ended unchanged.

Shares in Pembangunan Graha Lestari Tbk (JK:PGLI) rose to 52-week highs; up 34.76% or 65.00 to 252.00.

Crude oil for October delivery was down 0.22% or 0.14 to $62.23 a barrel. Elsewhere in commodities trading, Brent oil for delivery in November fell 0.15% or 0.10 to hit $66.27 a barrel, while the December Gold Futures contract rose 0.27% or 9.80 to trade at $3,683.40 a troy ounce.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.USD/IDR was down 0.12% to 16,397.90, while AUD/IDR fell 0.56% to 10,892.68.

The US Dollar Index Futures was up 0.13% at 97.65.

Which stocks should you consider in your very next trade?The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually. That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly. For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants. With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!

Screen for Stocks